Abstract

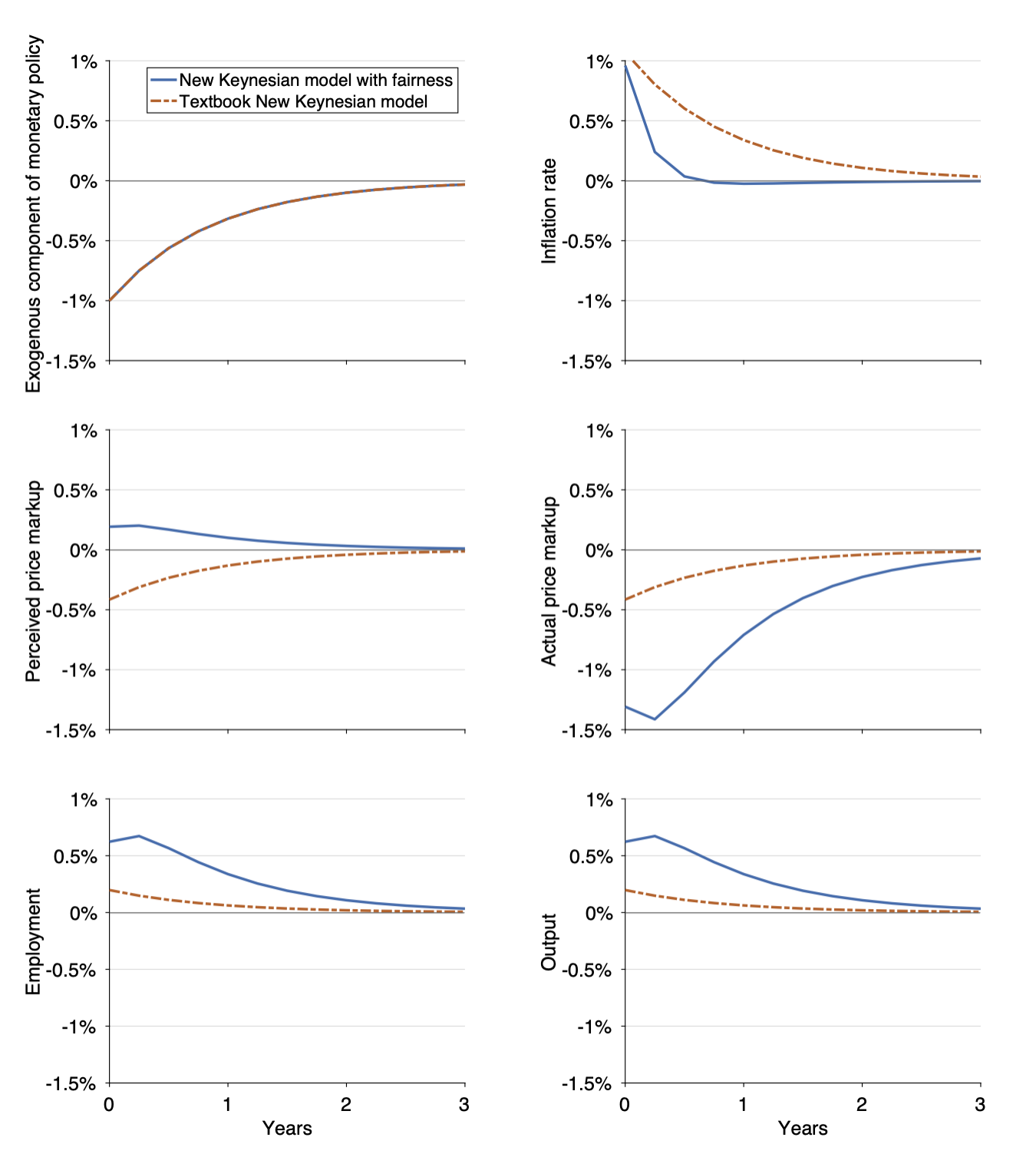

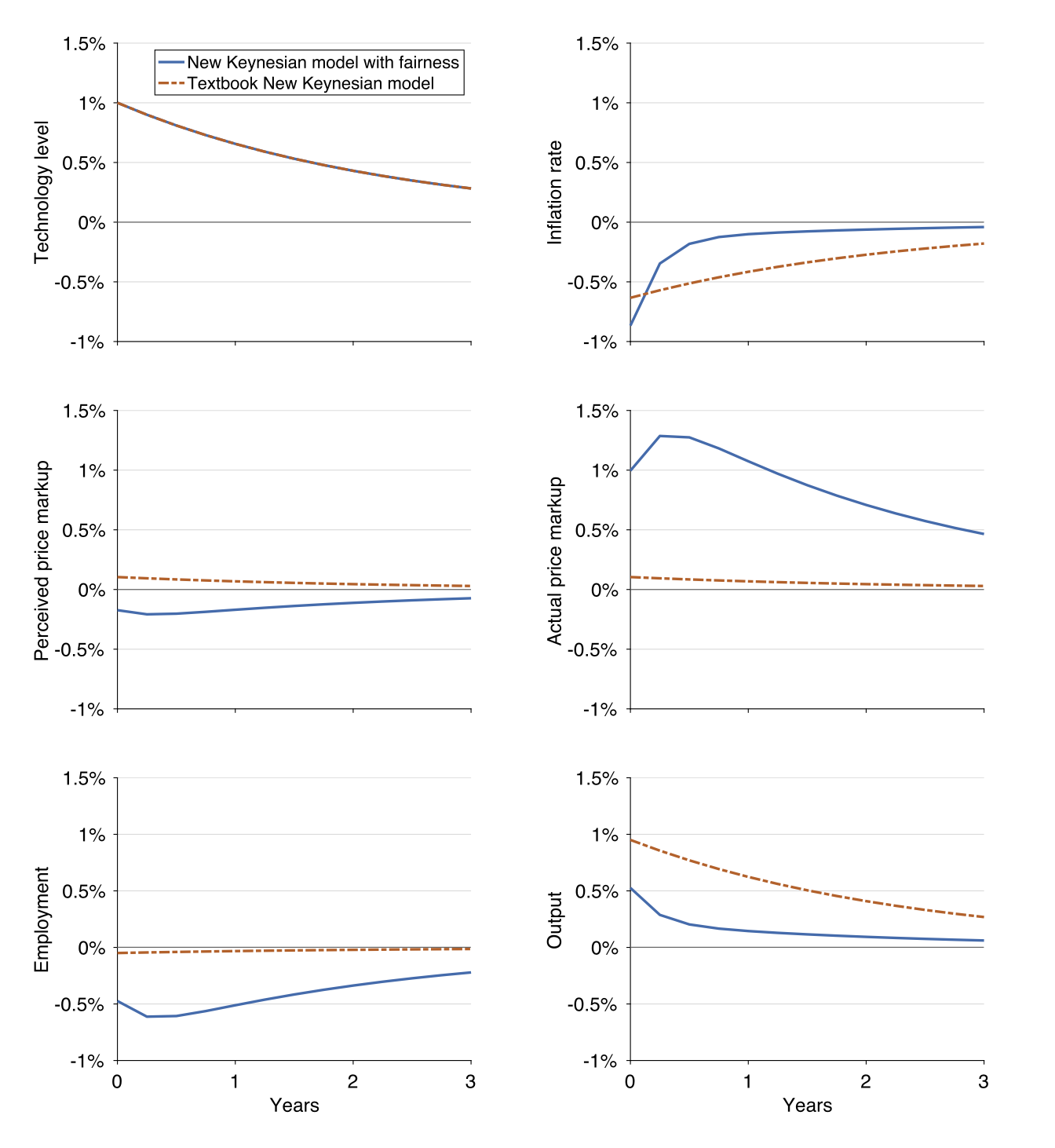

This paper proposes a theory of pricing premised upon the assumptions that customers dislike unfair prices—those marked up steeply over cost—and that firms take these concerns into account when setting prices. Because they do not observe firms’ costs, customers must extract costs from prices. The theory assumes that customers infer less than rationally: When a price rises due to a cost increase, customers partially misattribute the higher price to a higher markup—which they find unfair. Firms anticipate this response and trim their price increases, which drives the passthrough of costs into prices below one: Prices are somewhat rigid. Embedded in a New Keynesian model as a replacement for the usual pricing frictions, our theory produces monetary nonneutrality: When monetary policy loosens and inflation rises, customers misperceive markups as higher and feel unfairly treated; firms mitigate this perceived unfairness by reducing their markups; in general equilibrium, employment rises. The theory also features a hybrid short-run Phillips curve, realistic impulse responses of output and employment to monetary and technology shocks, and an upward-sloping long-run Phillips curve.

Figure 1: Impulse responses to an expansionary monetary shock in the New Keynesian model with fairness

Figure 2: Impulse responses to a positive technology shock in the New Keynesian model with fairness

Citation

Eyster, Erik, Kristof Madarasz, and Pascal Michaillat. 2021. “Pricing under Fairness Concerns.” Journal of the European Economic Association 19 (3): 1853–1898. https://doi.org/10.1093/jeea/jvaa041.

@article{EMM21,

author = {Erik Eyster and Kristof Madarasz and Pascal Michaillat},

year = {2021},

title = {Pricing under Fairness Concerns},

journal = {Journal of the European Economic Association},

volume = {19},

number = {3},

pages = {1853--1898},

url = {https://doi.org/10.1093/jeea/jvaa041}}

Related material

- Presentation slides

- Previous version of the paper (2019) – This version extends the pricing model to study disclosure of costs by firms. With disclosure, the passthrough of costs into prices is asymmetric. Firms choose to disclose cost increases but refuse to disclose cost decreases. As a result, firms pass through cost increases completely into prices but only pass through cost decreases incompletely into prices. The paper also provides photographic evidence of such behavior: firms commonly post signs alerting customers that costs increased so prices must go up too.