Abstract

This paper develops a new rule to detect US recessions by combining data on job vacancies and unemployment. We first construct a new recession indicator: the minimum of the Sahm-rule indicator (the increase in the 3-month average of the unemployment rate above its 12-month low) and a vacancy analogue. The minimum indicator captures simultaneous rises in unemployment and declines in vacancies. We then set the recession threshold to 0.29 percentage points (pp), so a recession is detected whenever the minimum indicator crosses 0.29pp. This new rule detects recessions faster than the Sahm rule: with an average delay of 1.2 months instead of 2.7 months, and a maximum delay of 3 months instead of 7 months. It is also more robust: it identifies all 15 recessions since 1929 without false positives, whereas the Sahm rule breaks down before 1960. By adding a second threshold, we can also compute recession probabilities: values between 0.29pp and 0.81pp signal a probable recession; values above 0.81pp signal a certain recession. In December 2024, the minimum indicator is at 0.43pp, implying a recession probability of 27%. This recession risk was first detected in March 2024.

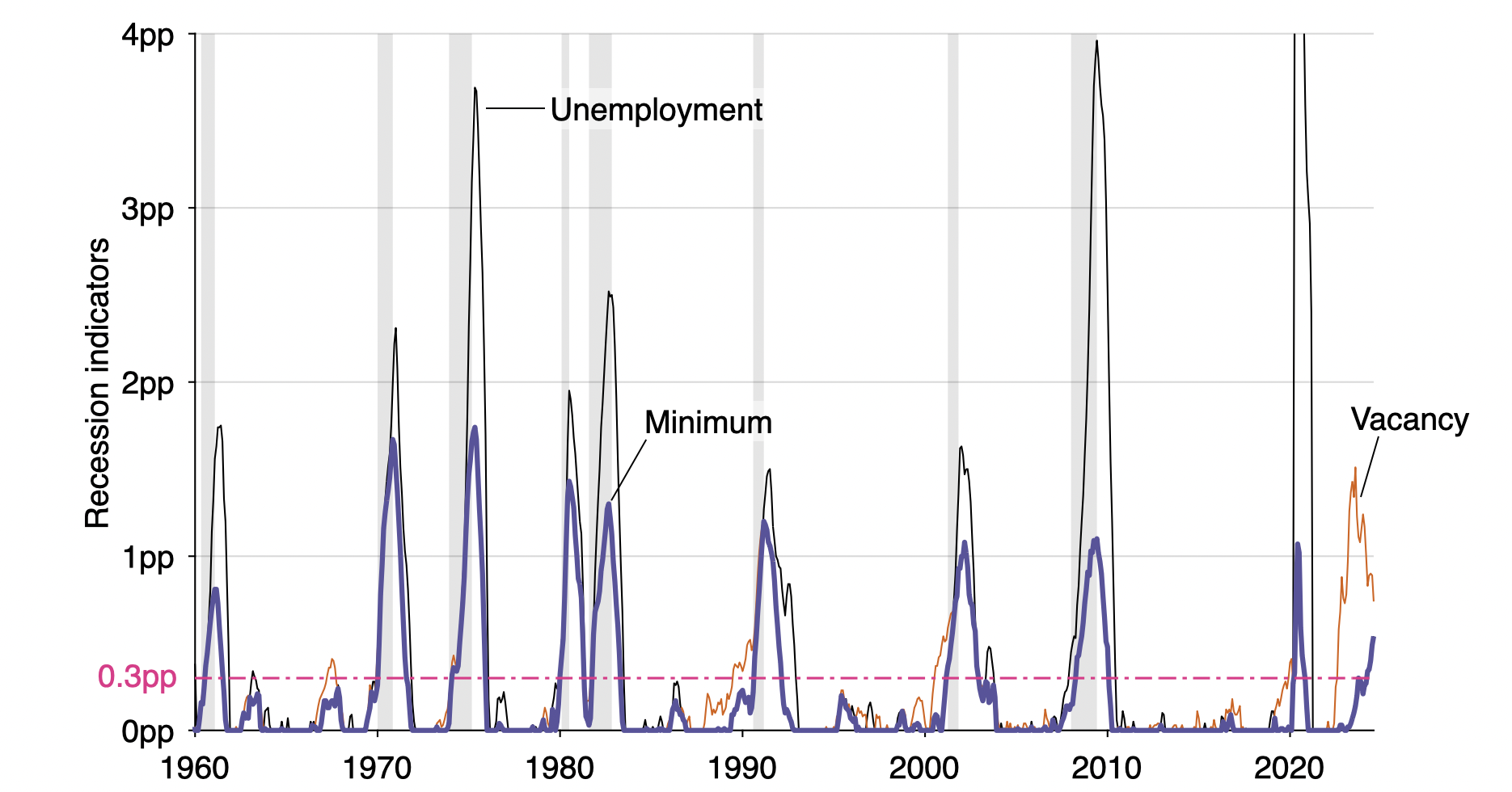

Figure 2: Construction of the Michez rule: unemployment and vacancy indicators, January 1960–December 2024

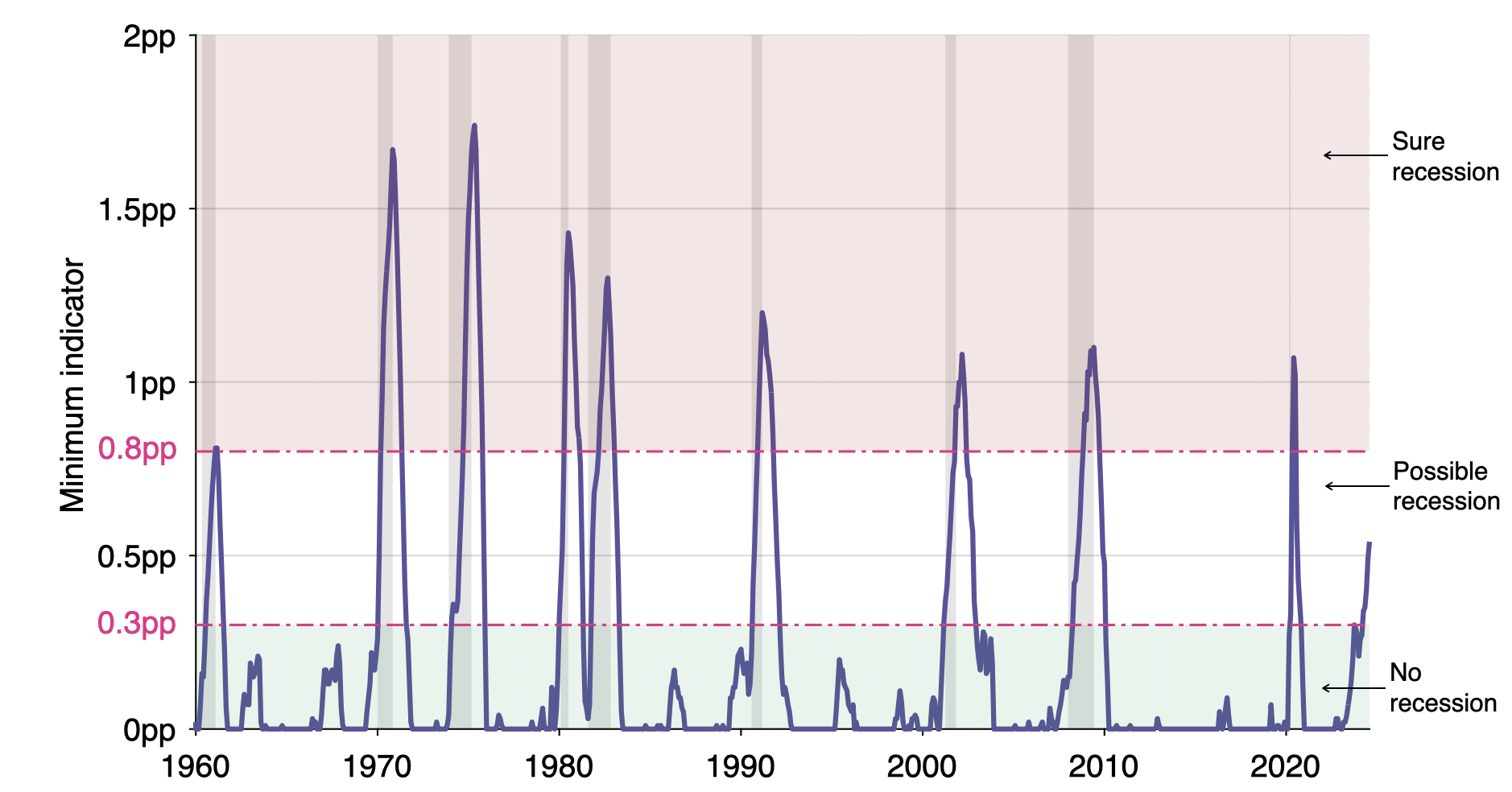

Figure 3: Michez rule in the United States, January 1960–December 2024

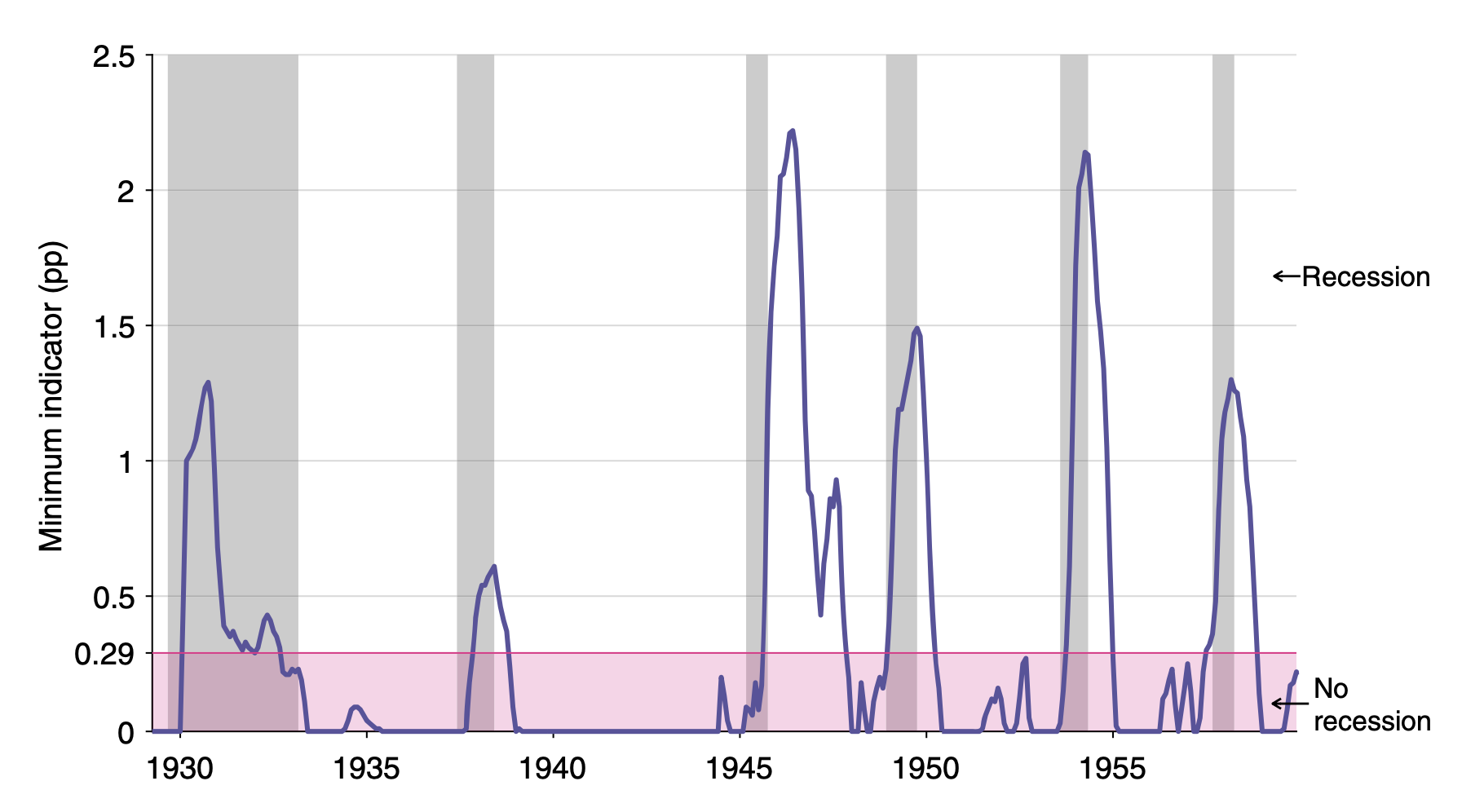

Figure 6: Michez rule in the United States, April 1929–December 1959

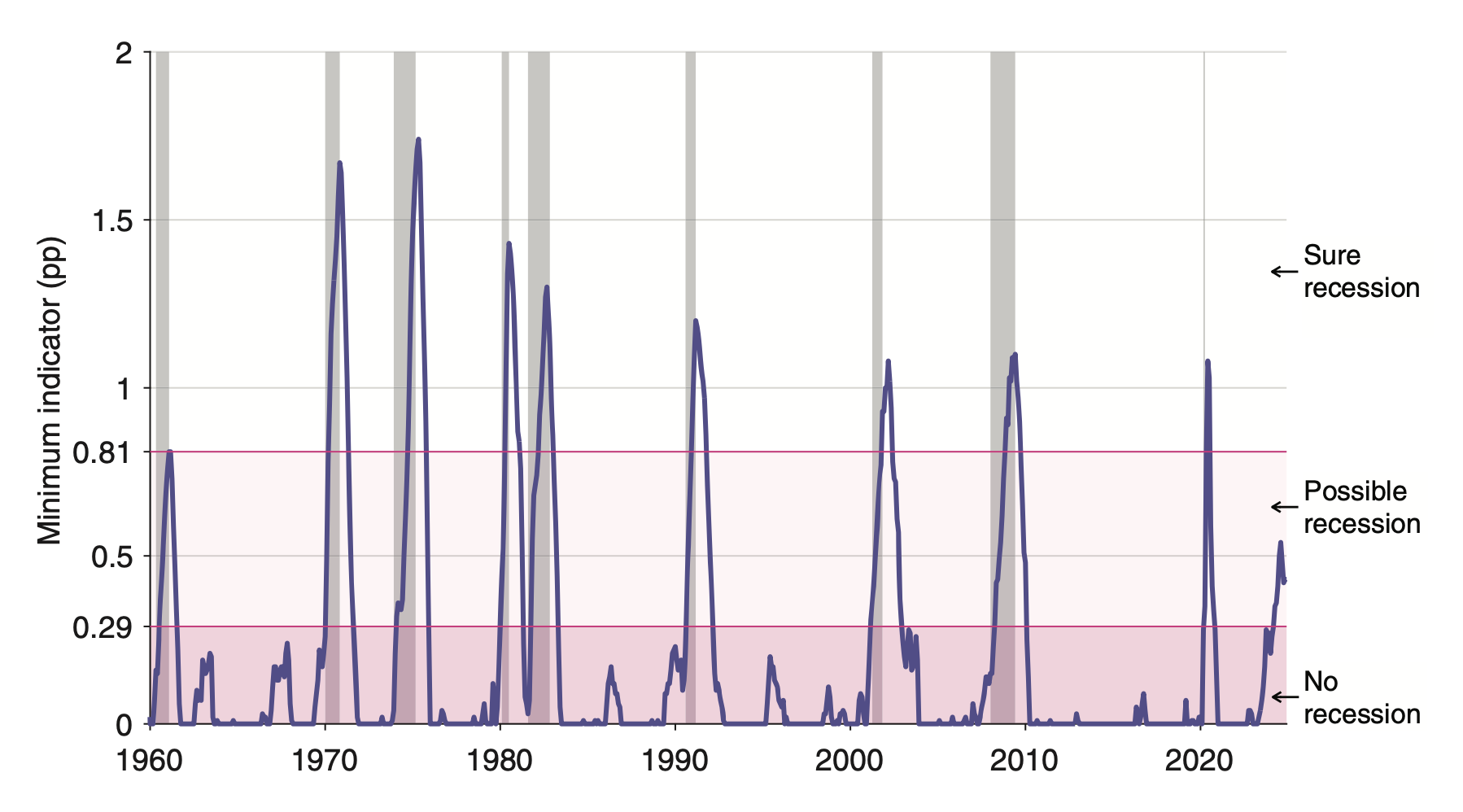

Figure 7: Dual-threshold Michez rule in the United States, January 1960–December 2024

Citation

Michaillat, Pascal, and Emmanuel Saez. 2025. “Has the Recession Started?” Oxford Bulletin of Economics and Statistics 87 (6): 1047–1058. https://doi.org/10.1111/obes.12685.

@article{MS25,

author = {Pascal Michaillat and Emmanuel Saez},

year = {2025},

title = {Has the Recession Started?},

journal = {Oxford Bulletin of Economics and Statistics},

volume = {87},

issue = {6},

pages = {1047--1058},

url = {https://doi.org/10.1111/obes.12685}}