Abstract

This paper proposes a new, Beveridgean model of the Phillips curve. While the New Keynesian Phillips curve is based on monopolistic pricing under price-adjustment costs, the Beveridgean Phillips curve is based on directed-search pricing under price-adjustment costs. Under directed-search pricing, prices respond to slack instead of marginal costs. The Beveridgean Phillips curve links the inflation gap to the unemployment gap, with the following properties. First, it produces the divine coincidence: it guarantees that the rate of inflation is on target whenever the rate of unemployment is efficient. Second, whenever the Beveridge curve shifts, the Phillips curve shifts if it is formulated with inflation and unemployment, but it remains unaffected if it is formulated with inflation and labor-market tightness. Third, the Phillips curve displays a kink at the point of divine coincidence if we assume that wage decreases—which reduce workers’ morale—are more costly to producers than price increases—which upset customers. These three properties describe recent US data well.

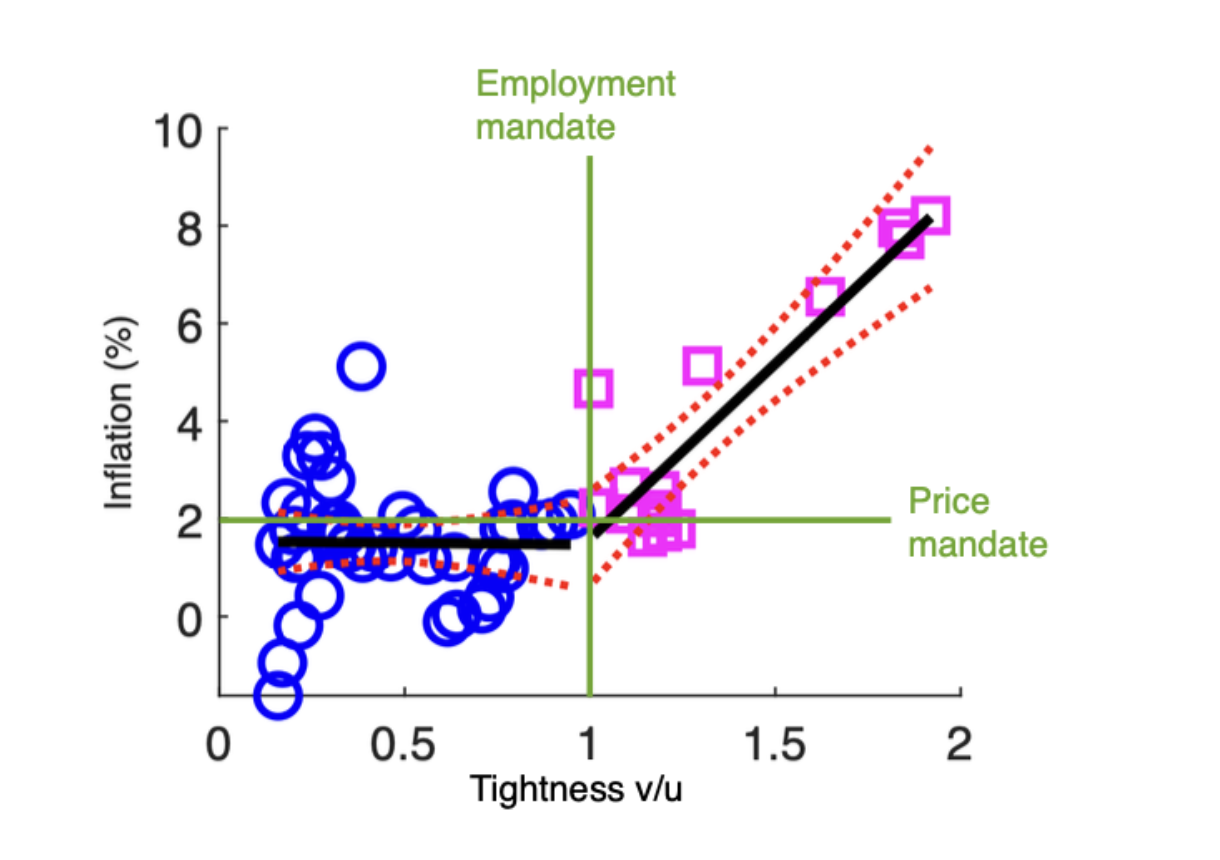

Figure 1: Phillips curve in the United States, 2020–2024

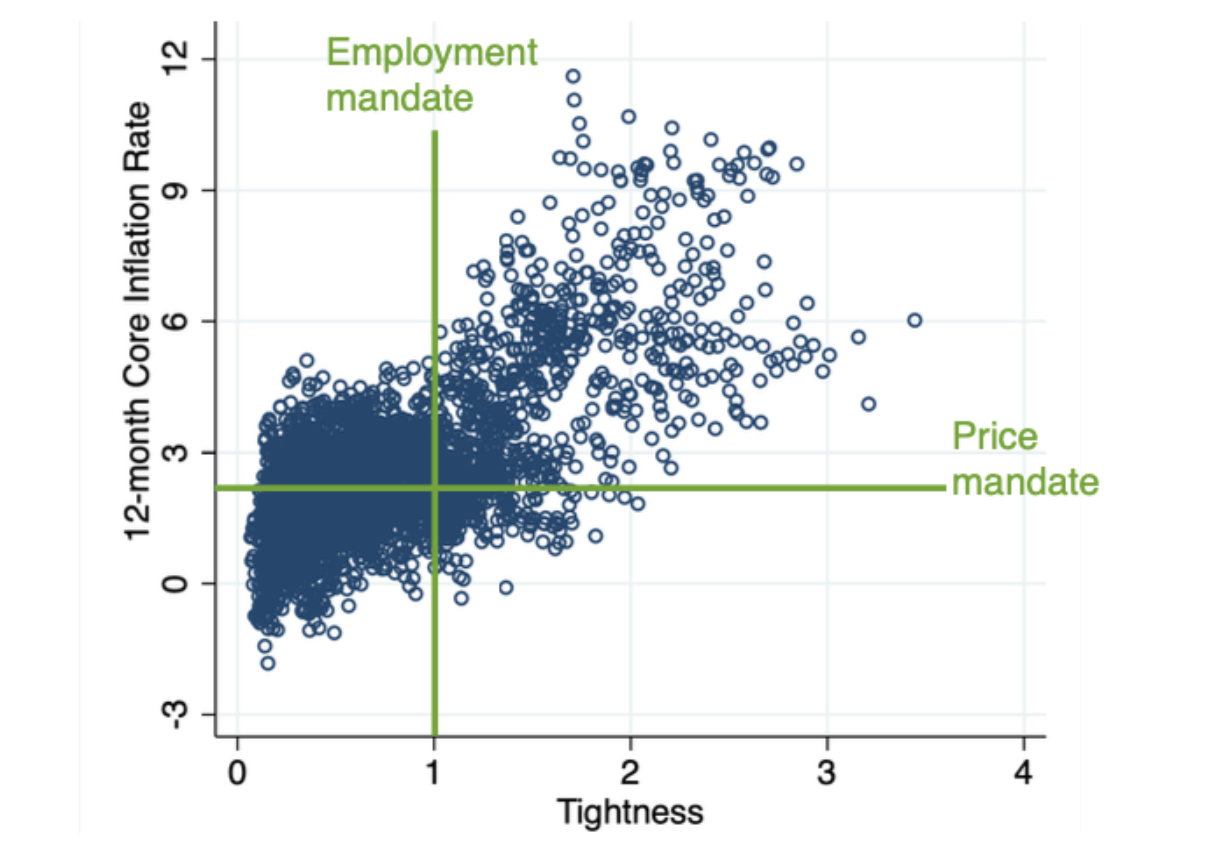

Figure 9A: Response to a negative aggregate-demand shock with a kinked Phillips curve

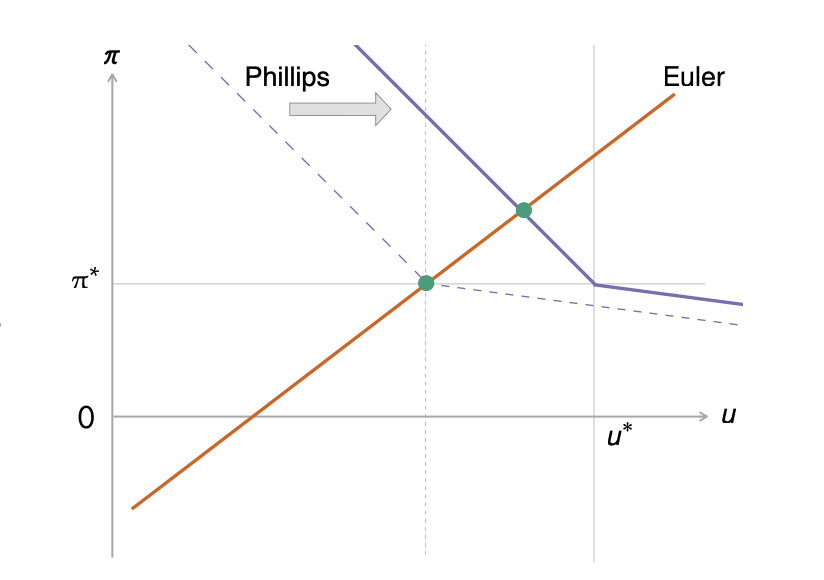

Figure 9B: Response to a negative aggregate-supply shock with a kinked Phillips curve

Citation

Michaillat, Pascal, and Emmanuel Saez. 2024. “Beveridgean Phillips Curve.” arXiv:2401.12475v2. https://doi.org/10.48550/arXiv.2401.12475.

@techreport{MS24,

author = {Pascal Michaillat and Emmanuel Saez},

year = {2024},

title = {Beveridgean Phillips Curve},

number = {arXiv:2401.12475v2},

url = {https://doi.org/10.48550/arXiv.2401.12475}}