Abstract

At the zero lower bound, the New Keynesian model predicts that output and inflation collapse to implausibly low levels and that government spending and forward guidance have implausibly large effects. To resolve these anomalies, we introduce wealth into the utility function; the justification is that wealth is a marker of social status, and people value status. Since people partly save to accrue social status, the Euler equation is modified. As a result, when the marginal utility of wealth is sufficiently large, the dynamical system representing the zero-lower-bound equilibrium transforms from a saddle to a source, which resolves all the anomalies.

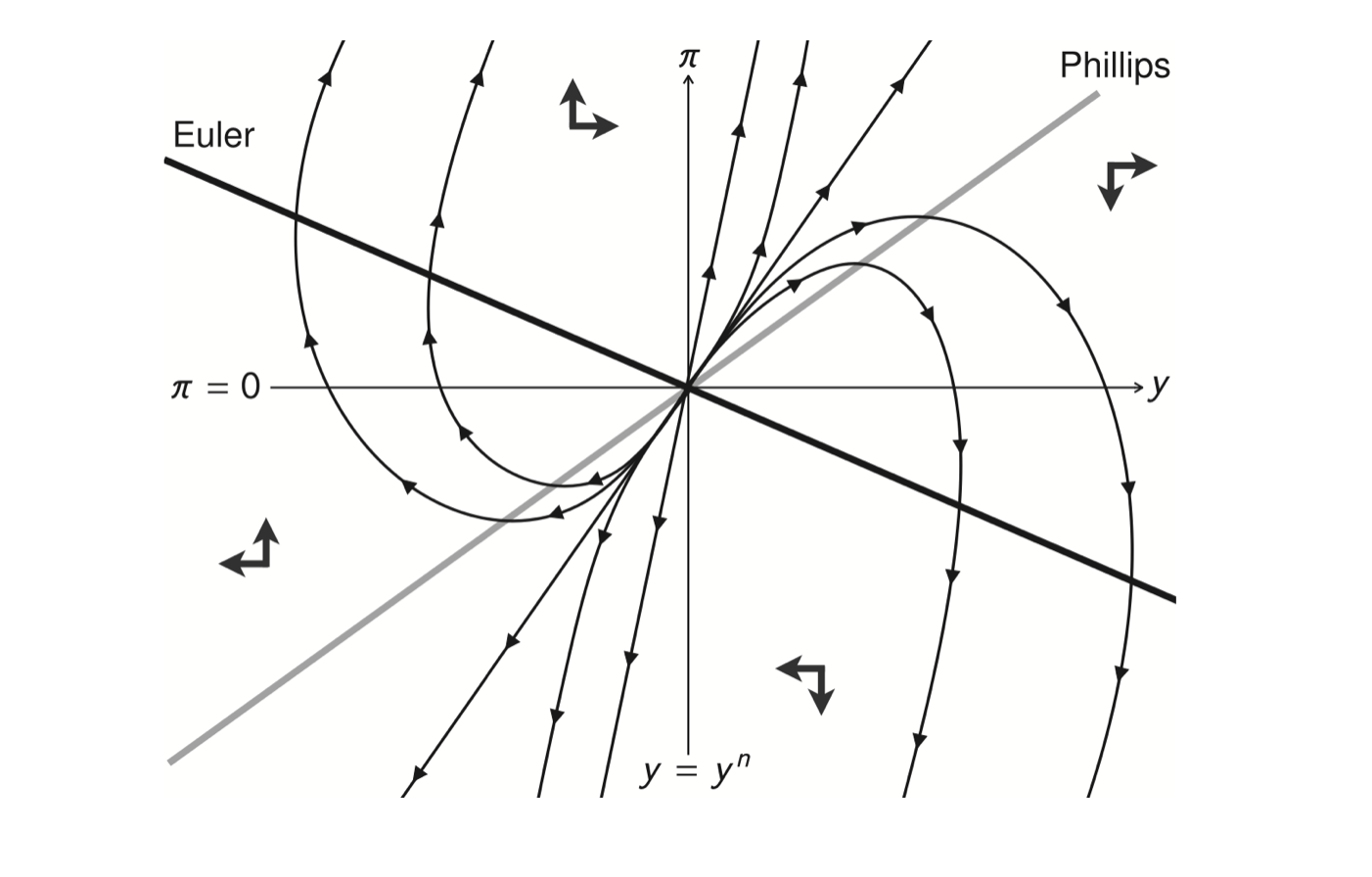

Figure 1A: New Keynesian model is a source in normal times with active monetary policy

Figure 1B: Wealth-in-the-utility New Keynesian model is a source in normal times with active monetary policy

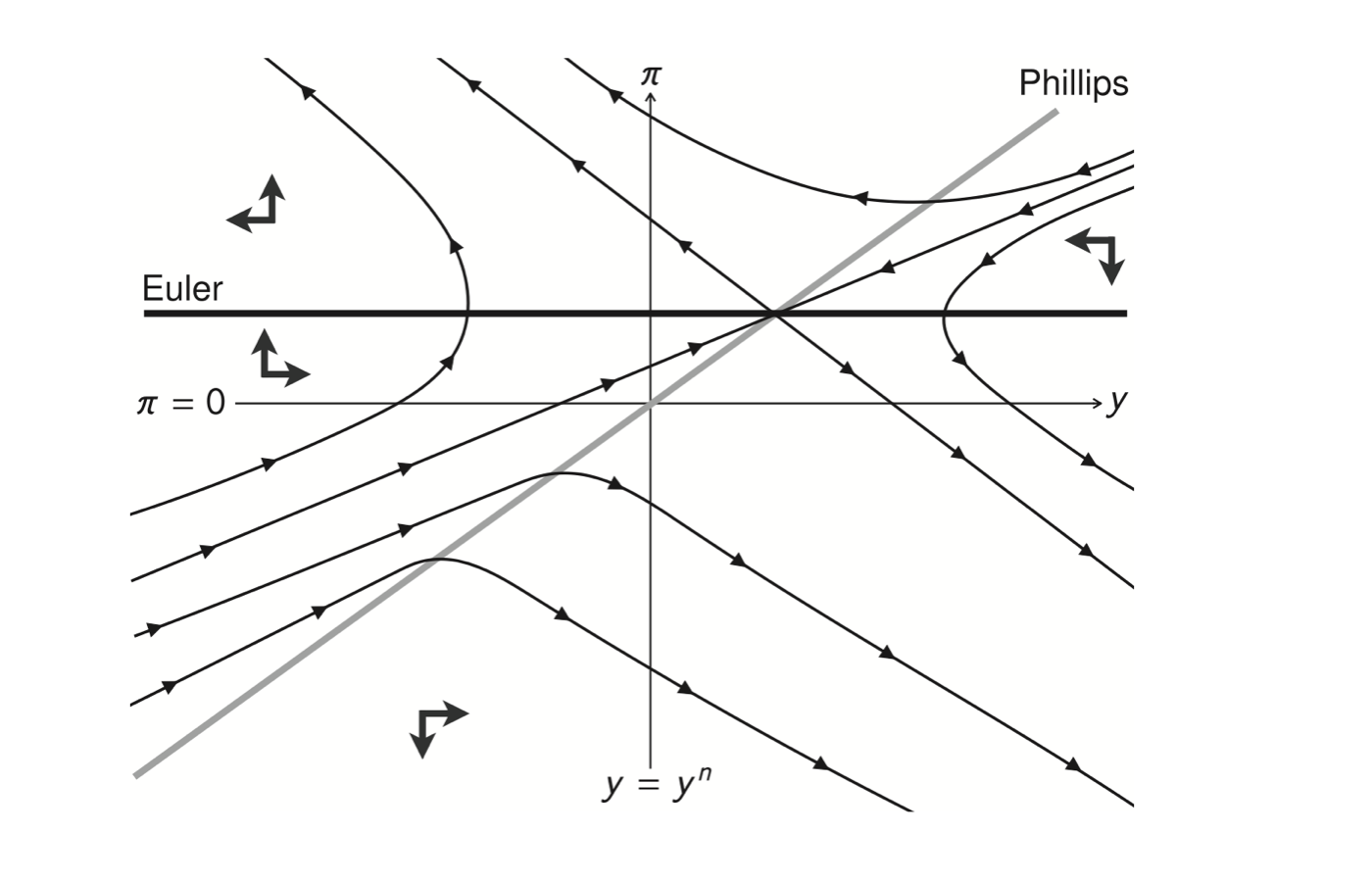

Figure 1C: New Keynesian model is a saddle at the zero lower bound

Figure 1D: Wealth-in-the-utility New Keynesian model is a source at the zero lower bound

Citation

Michaillat, Pascal, and Emmanuel Saez. 2021. “Resolving New Keynesian Anomalies with Wealth in the Utility Function.” Review of Economics and Statistics 103 (2): 197–215. https://doi.org/10.1162/rest_a_00893 .

@article{MS21,

author = {Pascal Michaillat and Emmanuel Saez},

year = {2021},

title ={Resolving {N}ew {K}eynesian Anomalies with Wealth in the Utility Function},

journal = {Review of Economics and Statistics},

volume = {103},

number = {2},

pages = {197--215},

url = {https://doi.org/10.1162/rest_a_00893}}